Today, Amazon announced the launch of Amazon Payment Services, a payment processing service in the Middle East and North Africa (MENA) region with a mission to empower businesses with simple, affordable, and trusted online payment experiences. The newly launched Amazon Payment Services provides secure online payment services that are easy-to-use, leveraging Amazon scalable and reliable technologies.

Established in 2013 as one of the first Fintech companies in the region, PAYFORT has gained a deep understanding of businesses’ needs across the region. In 2017, Amazon acquired PAYFORT as part of the Souq Group acquisition. Since then, the focus has been on integrating PAYFORT and Amazon offerings to provide businesses with a convenient and trusted service.

With the launch of Amazon Payment Services, businesses that use the service will continue to have access to a range of payment services that enables them to accept online payments using both global and local payment methods, offer installments to the customers to make purchases affordable for their customers, and monitor payment performance round the clock. As of today, PAYFORT is Amazon Payment Services.

Omar Soudodi, Managing Director, Amazon Payment Services, said: “Today’s launch marks another key milestone in Amazon’s promise to build the future of digital payments in the region, empowering businesses to provide user-friendly payment experience for their end-users. We listened to businesses across a broad range of industries to continue improving our offering. Amazon Payment Services is a natural next step in our journey, focusing on four fundamental pillars of trust, convenience, selection and pricing, underpinned by a best-in-class experience focused on reliability, scale and operational excellence.”

Amazon Payment Services processes transactions for thousands of businesses across multiple industries, ranging from aviation to travel and tourism, retail, insurance, real estate, government, and more. With such a diverse customer base, it has built strong expertise that supports businesses at every scale, from small and medium enterprises (SMEs) looking to establish their online presence to large-scale enterprises requiring a dependable payment service to handle high volumes of transactions safely.

Managing Director of Saudi Payments, Fahad I. Alakeel said, “Being in an extensive partnership with PAYFORT for several years, we are very excited about the next endeavor with Amazon Payment Services which will facilitate more opportunities for digital payments in Saudi Arabia in addition to diversifying secure and convenient contactless payment options for our Saudi consumers.”

“Our partnership with PAYFORT has extended for more than three years. And now, with the tremendous growth in Meeza customer base, we look forward to drive far more business impact through our partnership with Amazon. We are upbeat about the launch of Amazon Payment Services in Egypt, which we believe, will bring domestic online shopping into a new threshold.” Said Tarek Raouf, Egyptian Banks Company, Executive Chairman and CEO.

Amazon Payment Services also has a wide range of partners, including leading banks such as RAKBANK, First Abu Dhabi Bank (FAB), Mashreq, The Saudi British Bank (SABB), Al Rajhi Bank, Riyad Bank and National Commercial Bank (NCB). Partners also include local card schemes such as MADA, and Meeza, and international card schemes such as Visa, and MasterCard.

Soudodi added: “We understand the challenges of establishing an online business, so with this new launch, we have simplified the process of setting up merchant accounts to allow businesses to quickly begin accepting payments online, regardless of their size or the nature of their business. Amazon Payment Services mechanisms include simple-to-understand descriptions of services and their impact on a business, demonstrations of the end-customer experience, in addition to the ability to provide feedback proactively, alongside full secure transparency into pricing.”

New businesses using Amazon Payment Services, will be able to easily accept online payments by choosing from selection of services that fit their customer needs and access rich content to help them with their digital transformation.

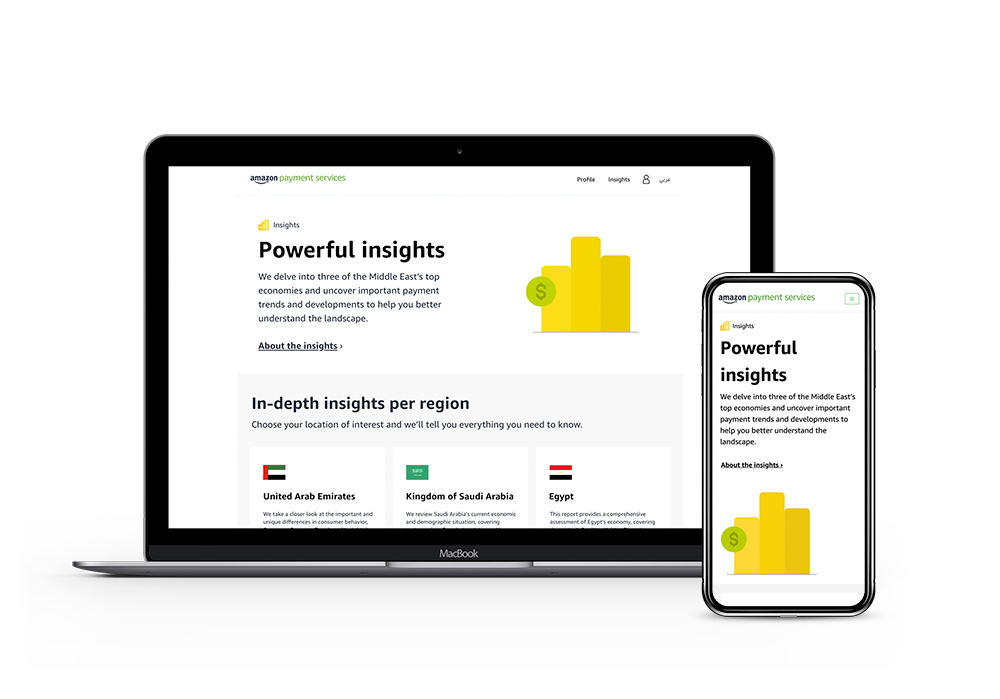

Amazon Payment Services has also introduced new and enhanced services that will allow businesses to serve their customers better, including detailed reports with actionable insights and real-time monitoring of their payment activities. As part of the new set of services, businesses can get better transaction authentication and reduce friction at checkout. Businesses can also build their own dashboard by merging their data from different sources which helps them track and meet their goals.

To learn more about offerings from Amazon Payment Services, please visit: paymentservices.amazon.com